Crypto wallet provider Exodus Movement's planned listing on the NYSE American exchange has been postponed as the US Securities and Exchange Commission (SEC) is still reviewing its registration statement.

The US SEC has maintained Ripple should pay close to $2 billion in fines for selling XRP to institutional investors, in response to the fintech firm’s counter-proposal that argued for a fine of around $10 million.

US President Joe Biden’s office has issued a statement declaring its intention to veto a congressional resolution to undermine the SEC’s cryptocurrency policy, saying it “strongly opposes” the resolution.

Top stories in the Crypto Roundup today:

- Crypto Wallet Provider Exodus’ NYSE Listing Put on Hold

- SEC Stands Firm on $2 Billion Fine for Ripple

- Biden Administration to Veto Resolution Affecting SEC’s Crypto Policy

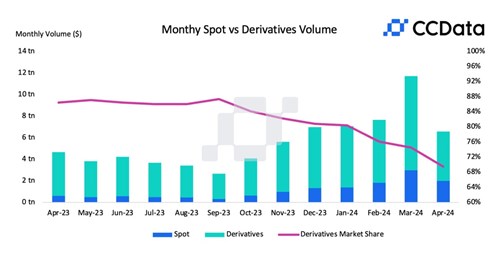

- Trading Volumes on Centralised Exchanges Drop After Seven Months