The spot Bitcoin exchange-traded funds (ETFs) that started trading earlier this month now collectively hold 95,000 BTC after just six full trading days, with their assets under management (AUM) now nearing $4 billion.

The U.S. Securities and Exchange Commission (SEC) has acknowledged proposals from Nasdaq and Cboe to initiate option trading on Bitcoin ETFs, reflecting growing interest in cryptocurrency-based financial products.

Brazil’s leading stock exchange B3 is set to introduce night trading sessions later this year, in a significant step that will include Bitcoin ETFs and futures contracts on Ibovespa, the country’s flagship stock market index.

Top stories in the Crypto Roundup today:

- Spot Bitcoin ETFs See AUM Rise to Near $4 Billion

- Nasdaq and Cboe Seek SEC Approval for Options Trading on Bitcoin Funds

- Brazil’s Leading Exchange to Launch Night Trading Sessions for Bitcoin ETFs and Ibovespa Futures

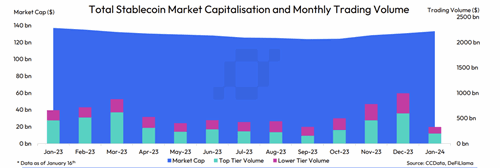

- Stablecoins Witness Fourth Consecutive Month of Growth