|

Bitcoin is nearing its longest winning streak in a year, bolstered by the unprecedented success of new spot exchange-traded funds (ETFs) in the US dedicated to the cryptocurrency, as it’s now trading above $48,000 a coin.

Bitcoin’s halving events have historically been a boon for the cryptocurrency’s price and with the next one set to occur in mid-April, various analysts are pointing to price surges. Grayscale analysts, however, suggest these surges aren’t solely attributed to reduced BTC supply.

New York Attorney General (NYAG) Letitia James has intensified her legal battle against the Digital Currency Group (DCG) and other cryptocurrency entities, alleging investor losses of over $3 billion.

Top stories in the Crypto Roundup today:

- Bitcoin on Track for Longest Winning Streak in a Year

- Ordinals Have Driven Over $200 Million in Fees for Bitcoin Miners

- NYAG Expands Crypto Lawsuit Against DCG, Gemini to $3 Billion

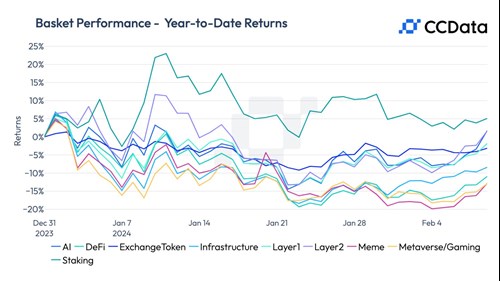

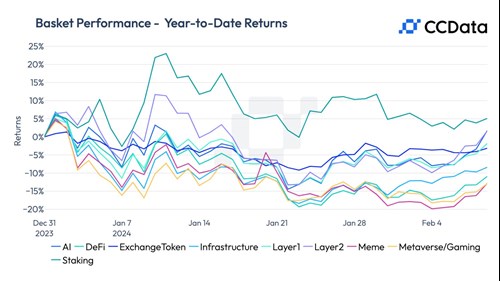

- Cryptocurrency Basket Performances YTD Show Staking, Layer-2 Tokens Lead

|

|

Bitcoin on Track for Longest Winning Streak in a Year

|

Bitcoin is nearing its longest winning streak in a year, bolstered by the unprecedented success of new spot exchange-traded funds (ETFs) in the US dedicated to the cryptocurrency, as it’s now trading above $48,000 a coin.

This surge in Bitcoin's price comes after the launch of several spot Bitcoin ETFs in the US on January 11, which have collectively attracted over $9 billion in investor inflows. Notably, ETFs from BlackRock and Fidelity Investments have become the most successful launches in terms of assets accumulated within a month, according to Bloomberg Intelligence analysts Eric Balchunas and James Seyffart.

The launch of these funds also saw the Grayscale Bitcoin Trust, the largest Bitcoin Trust, transition into an ETF. Following its conversion, the trust witnessed significant outflows of more than $6bn, however, outflows have recently started slowing.

Altogether, the ten new ETFs have netted $2.8 billion in investments. The excitement surrounding these ETFs sparked a Bitcoin rally, pushing its price briefly above $49,000 on their debut day. However, a subsequent $10,000 sell-off occurred as investors took profits and assessed the ETFs' performance.

Adding to Bitcoin's positive momentum is the anticipation of the upcoming halving event in April, which will cut Bitcoin miners’ rewards per block in half.

|

Ordinals Have Driven Over $200 Million in Fees for Bitcoin Miners

|

Bitcoin’s halving events have historically been a boon for the cryptocurrency’s price and with the next one set to occur in mid-April, various analysts are pointing to price surges. Grayscale analysts, however, suggest these surges aren’t solely attributed to reduced BTC supply.

In a report, Grayscale’s analysts pointed out that other cryptocurrencies with similar halving events, like Litecoin, haven’t seen consistent price growth post-halving, indicating that reduced supply can impact prices, but other factors, including broader economic conditions, also play a significant role.

Bitcoin’s halving will see the block reward miners receive get cut in half, from 6.25 BTC to 3.125 BTC per block. The drop in rewards poses a challenge for miners, as mining difficulty has also been steadily increasing over the past year.

To prepare for these changes, miners have been liquidating Bitcoin holdings and seeking additional capital in the last quarter of 2023. Grayscale’s analysts, however, note that Ordinals activity on the Bitcoin chain has been a boon for miners, who have earned over $200 million in transaction fees from it. Transactions related to ordinals account for about a fifth of the miners' income.

|

NYAG Expands Crypto Lawsuit Against DCG, Gemini to $3 Billion

|

New York Attorney General (NYAG) Letitia James has intensified her legal battle against the Digital Currency Group (DCG) and other cryptocurrency entities, alleging investor losses of over $3 billion.

In October, the New York Attorney General filed a lawsuit against DCG, its subsidiary Genesis Global Capital, and the Winklevoss twins’ exchange Gemini Trust, accusing them of misleading investors and causing losses exceeding $1 billion through the Gemini Earn program.

The program offered investors returns for lending their crypto assets through it. As the investigation progressed and more investors came forward, the NYAG said, it found that it also affected investors who sent funds directly to Genesis.

The NYAG is now seeking restitution exceeding $3 billion on behalf of the more than 230,000 investors believed to have been affected, significantly widening the scope and scale of the legal action against DCG and its affiliates.

The DCG has said the lawsuit was “baseless” and expects to win against it in court, defending the firm has “always conducted its business lawfully and with integrity, and DCG and Barry Silbert will be fully vindicated.”

Last week, Genesis agreed to pay the U.S. Securities and Exchange Commission (SEC) $21 million, contingent on customer repayments coming first, while Gemini sued former partner DCG over their failed lending program.

|

Cryptocurrency Basket Performances YTD Show Staking, Layer-2 Tokens Lead

|

While Bitcoin’s price moves closer to the $50,000 mark, diversifying in different cryptocurrency baskets has, so far this year, offered varying degrees of protection, with only staking and layer-2 tokens having positive performances so far this year.

Memecoins, metaverse and gaming tokens, and decentralized finance (DeFi) baskets have performed worst, dropping between 11.1% and 13.2% year-to-date.

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CCDATA

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|