Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM), has approved the launch of a spot Solana exchange-traded fund (ETF), marking the launch of the first product of its kind in the country.

Grayscale and Bitwise are seeking regulatory approval to offer options trading on their spot Ethereum ETFs, according to a filing submitted Wednesday with the SEC.

The UK’s Financial Conduct Authority (FCA) has issued over 1,000 warnings to cryptocurrency firms since introducing stricter marketing rules last October, which require firms to be registered with it to reach out to clients in the UK.

Top stories in the Crypto Roundup today:

- Brazil’s Securities Regulators Greenlights Spot Solana ETF

- Grayscale and Bitwise Seek Approval to List Options on Spot Ethereum ETFs

- UK’s Financial Regulator Issued Over 1,000 Warnings to Crypto Firms Since October

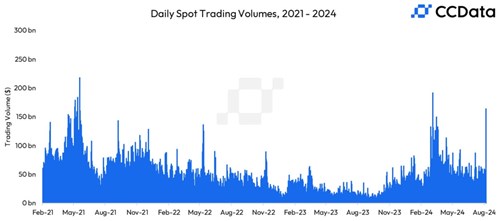

- Crypto Market Records Second-Highest Daily Spot Volume Since 2021