The world’s largest asset manager, BlackRock, has filed an application with the U.S. Securities and Exchange Commission (SEC) for a spot Ether exchange-traded fund (ETF), called the iShares Ethereum Trust.

Leading stablecoin issuer Tether, the company behind USDT, is moving to become one of the world's leading Bitcoin miners, making a hefty investment in the competitive sector through the construction of its own mining facilities and taking stakes in other firms.

The managing director of the International Monetary Fund (IMF) has suggested that central bank digital currencies (CBDCs) could replace physical cash in the global financial system.

Top stories in the Crypto Roundup today:

- BlackRock Files for Spot Ether ETF

- Tether to Spend $500 Million on Bitcoin Mining Expansion

- IMF Exec Says CBDCs Could Replace Cash in the Future

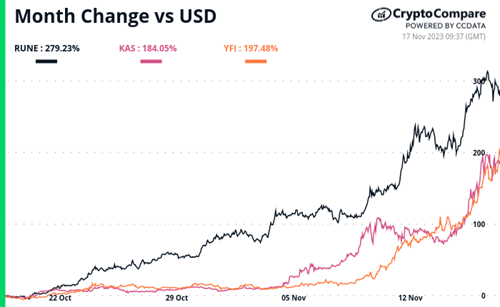

- Crypto Market Movers – RUNE, KAS, YFI