|

|

The Bank of England and HM Treasury are consulting on the potential launch of a digital pound, a central bank digital currency (CBDC), which would be issued by the central bank and could be used for everyday payments, but would have a £20,000 cap per person.

MicroStrategy co-founder and Executive Chairman Michael Saylor has said that the enterprise software company is considering adding futures contracts to its cryptocurrency strategy through CME Group’s marketplace in a bid to generate yield.

Leading cryptocurrency exchange Binance has announced that it will airdrop $100 in BNB to all Binance users identified to be living in the regions affected by the earthquakes in Turkey.

Sponsored: B2Broker, a provider of white-label liquidity for FX and crypto markets, has expanded its globally recognized white-label liquidity products for digital businesses. By integrating Match-Trader into its white-label solution, B2Broker has demonstrated its commitment to providing customers with the most comprehensive and versatile solution on the market.

Top stories in the Crypto Roundup today:

- Bank of England Weighs CBDC With £20,000 Cap

- MicroStrategy Considers Adding Bitcoin Futures to Its Crypto Strategy

- Binance to Airdrop $100 in BNB to Users Affected by Earthquakes in Turkey

- Bitcoin and Ethereum’s Monthly Returns, Jan 2021 to 2023

- Sponsored: B2Broker and Match Trader Announce Powerful Integration for New White Label Model

|

|

Bank of England Weighs CBDC With £20,000 Cap

|

The Bank of England and HM Treasury are consulting on the potential launch of a digital pound, a central bank digital currency (CBDC), which would be issued by the central bank and could be used for everyday payments but would have a £20,000 cap per person.

The consultation was launched because both entities “want to ensure the public have access to safe money that is convenient to use as our everyday lives become more digital, while supporting private sector innovation, choice and efficiency in digital payments.”

The digital pound, if launched, would be interchangeable with cash and bank deposits, meaning £10 of a digital pound would be worth the same as £10 in cash. The Bank of England says neither the central bank nor the government would have access to personal data, and holders would have the “same level of privacy as a bank account.”

The digital pound would, however, not be anonymous as the “ability to identify and verify users is necessary to prevent financial crime.” It would use a central ledger provided by the Bank of England. Their announcement reads:

“The Bank would provide the central public infrastructure in the form of a ‘core ledger’ – a fast, resilient, secure technology platform – which would provide the minimum necessary functionality.”

The digital pound would be used through digital wallets provided by banks, but the Bank of England has suggested Britons would be limited to holding £20,000 each of the digital currency.

Money above that cap would be “swept” into a customer’s commercial bank account, as the digital pound would not be a means for storing wealth. It could be launched in the second half of this decade.

|

MicroStrategy Considers Adding Bitcoin Futures to Its Crypto Strategy

|

MicroStrategy co-founder and Executive Chairman Michael Saylor has said that the enterprise software company is considering adding futures contracts to its cryptocurrency strategy through CME Group’s marketplace in a bid to generate yield.

MicroStrategy had previously rejected the idea of lending its Bitcoin through other companies, some of which went bankrupt last year. The firm started investing in Bitcoin in August 2020, and has so far accumulated 132,500 BTC, worth about $3 billion.

In an interview with Bloomberg, Saylor said he didn’t plan on separating MicroStrategy’s enterprise-software and Bitcoin businesses. The firm reported a net loss of $249.7 million in the fourth quarter of 2022, with revenue falling 1.5% to $132.6 million.

The company recorded an impairment charge of $197.6 million, reflecting a drop in the value of its Bitcoin holdings and net sales gains.

|

Binance to Airdrop $100 in BNB to Users Affected by Earthquakes in Turkey

|

Leading cryptocurrency exchange Binance has announced that it will airdrop $100 in BNB to all Binance users identified to be living in the regions affected by the earthquakes in Turkey.

The exchange is set to identify affected users based on their Proof of Address (POA) completed before February 6, in 10 cities where the disaster had a significant impact, including Kahramanmaraş, Kilis, Diyarbakır, Adana, Osmaniye, Gaziantep, Şanlıurfa, Adıyaman, Malatya and Hatay.

The exchange estimated it would be donating around $5 million to affected users, worth around 94 million Turkish Lira. It noted that cryptocurrency transfers are “now increasingly being used to deliver financial aid to disaster victims,” as they provide fast and cheap borderless transactions.

Binance Charity has also established a public donation address for individuals to contribute. All funds received at this address, the exchange says, will be converted to Turkish Lira and donated to a reputable NGO to support those in need. The Emergency Earthquake Appeal is accepting donations in various cryptocurrencies, including BTC, ETH, BNB, BUSD, and XRP.

|

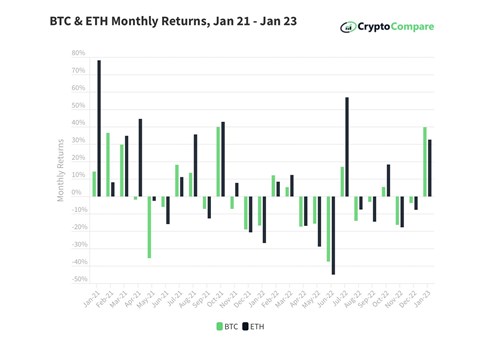

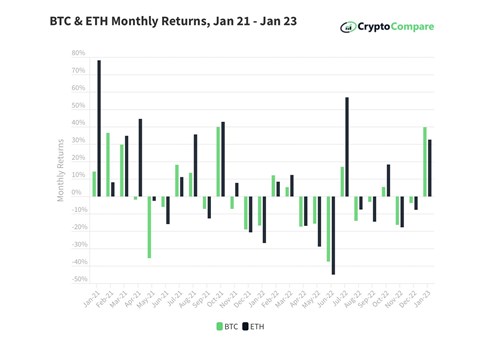

Bitcoin and Ethereum’s Monthly Returns, Jan 2021 to 2023

|

The digital asset market experienced a significant rise in activity during January, providing positive returns that were well received by market participants.

Bitcoin and Ethereum saw their best performance since October 2021 and July 2022 respectively, with returns of 39.9% and 32.7%.

Dive deeper into the latest market trends with CryptoCompare’s latest Market Spotlight.

|

|

|

|

|

B2Broker and Match Trader Announce Powerful Integration for New White Label Model

|

B2Broker, a provider of white-label liquidity for FX and crypto markets, has expanded its globally recognized white-label liquidity products for digital businesses. By integrating Match-Trader into its white-label solution, B2Broker has demonstrated its commitment to providing customers with the most comprehensive and versatile solution on the market.

The Match-Trader white-label solution streamlines all necessary technology into a single product, reducing costs for brokers and offering a complete Match-Trader experience. The product includes B2BinPay (a platform for processing cryptocurrency payments), B2Core (a CRM system), and access to B2Broker's Prime of Prime liquidity pool.

With round-the-clock server and technical support, dedicated account managers, and training sessions, Match-Trader offers a stress-free online trading experience. Additionally, businesses can benefit from competitive commissions and a favorable volume charge, with a free platform configuration and no setup fees. The product requires a minimum liquidity fee for three months as an initial investment, with a grace period of a whole calendar month.

B2Broker also offers a white-label solution that integrates Match-Trader with B2Core, allowing brokers to provide their customers with a high-quality trading experience. The Match-Trader section of the B2Core website provides new capabilities and features, including the ability to process transactions and access to the platform.

Incorporating Match Trader into its offering, B2Broker provides brokers with a robust and exciting solution for their customers. The package offers a wide range of powerful tools, making it a perfect fit for organizations looking for advanced technology. In the future, Match Trader will be incorporated into IB's programming, providing traders access to a wide range of professional-grade options.

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CoinDesk Data

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|