The Bitcoin white paper has been found within every modern version of the operating system for Apple’s Mac computers. Technologic Andy Baio first revealed that a PDF of the Bitcoin white paper was “apparently shipped with every copy of macOS since Mojave in 2018.”

Nasdaq-listed business intelligence firm MicroStrategy has announced it acquired an additional 1,045 Bitcoin for approximately $29.3 million, at an average price of $28,016 per BTC, bringing its total holdings to 140,000 BTC.

Adrienne Harris, the head of the New York Department of Financial Services (NYDFS), said it was “ludicrous” to think that Signature Bank’s closure last month had anything to do with “Operation Choke Point 2.0.”

Top stories in the Crypto Roundup today:

- Bitcoin White Paper Found Hidden in Apple’s MacOS

- MicroStrategy Buys an Additional 1,045 BTC

- NYDFS Chief Denies Crypto Crackdown Behind Bank Closures

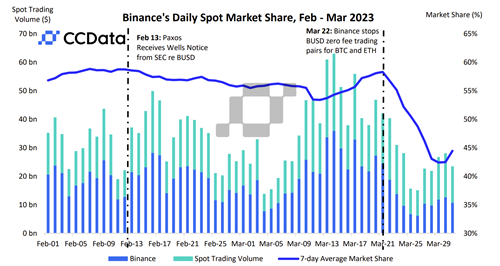

- Binance’s Spot Market Share Slides After Halting Trading Incentives