Google’s cloud computing division, Google Cloud, has announced it’s now running a validator node on the Solana blockchain, and is set to add features aimed at welcoming Solana developers and node runners.

Leading cryptocurrency exchange Binance has announced it has decided to sell all of its remaining FTT tokens. FTT is the native token of the FTX ecosystem, a rival cryptocurrency exchange.

Popular non-fungible token (NFT) marketplace OpenSea has seemingly taken a position in the NFT royalties debate with the launch of a new blockchain-based tool to help creators enforce royalties.

Top stories in the Crypto Roundup today:

- Google Cloud Becomes Solana Network Validator

- Binance to Sell Over $500 Million Worth of FTX’s FTT Token

- OpenSea Launches Blockchain Tool to Enforce NFT Royalties

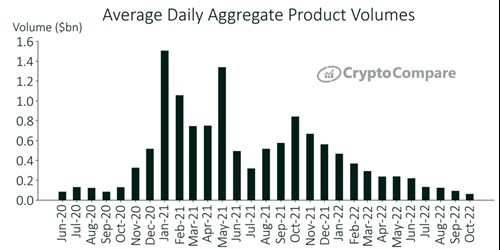

- Average Daily Aggregate Product Volumes