|

|

Russia's crypto volumes appear to be stalling following a surge in Bitcoin trading volumes denominated in the Russian ruble, the country's fiat currency. The surge came after Russia's announcement of a "special military operation" in Ukraine.

The Swiss city of Lugano has formed a partnership with stablecoin issuer Tether to establish BTC, USDT, and Lugano’s own LGVA Points token as legal tender in the city, in a move that goes beyond Swiss localities accepting crypto for tax payments.

The Ukrainian government has abruptly canceled its planned cryptocurrency airdrop and revealed is instead going to be selling non-fungible tokens (NFTs) to raise funds The change was announced by Mykhailo Fedorov, Ukraine's minister for digital transformation.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- Ruble-Denominated Bitcoin Volumes Wane

- Swiss City to Make Bitcoin and Tether Legal Tender

- Ukraine Cancels Crypto Airdrop, Plans NFT Sale

- Crypto Market Movers – UMA, KEEP, KNC

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

|

Ruble-Denominated Bitcoin Volumes Wane

|

Russia's crypto volumes appear to be stalling following a surge in Bitcoin trading volumes denominated in the Russian ruble, the country's fiat currency. The surge came after Russia's announcement of a "special military operation" in Ukraine.

Data shows that residents in the sanction-hit country have seemingly been in no hurry to trade on cryptocurrency exchanges, with ruble-denominated BTC trading volumes plunging from $4.5 million the day the war started to around $400,000. In May 2021, ruble-denominated BTC volumes hit $33 million a day.

Citigroup has estimated that actual bitcoin buying in the nation was around 210 BTC on average per day in the past week, while trading volumes range between $20 to $40 billion. The stalling volumes throw off the Russians-are-evading-sanctions-via-crypto narrative.

Citi analysts including Alexander Sanders said in a report that Russian volumes “have been relatively small so far, suggesting that the price action is more due to investors positioning for an expected uptick in demand from Russia” rather than demand from Russia itself.

|

Swiss City to Make Bitcoin and Tether Legal Tender

|

The Swiss city of Lugano has formed a partnership with stablecoin issuer Tether to establish BTC, USDT, and Lugano’s own LGVA Points token as legal tender in the city, in a move that goes beyond Swiss localities accepting crypto for tax payments.

Lugano is allowing cryptocurrency payments for taxes, while also aiming to have all of its businesses seamlessly use crypto for everyday transactions. The move was described as a “de facto” legalization, as the Swiss franc will remain the actual legal tender in the city.

Lugano is Switzerland’s ninth-largest city with a population of over 62,000 people. It’s in the Italian-speaking southern part of the country and is looking to host the Bitcoin World Forum on Oct. 26-28.

|

Ukraine Cancels Crypto Airdrop, Plans NFT Sale

|

The Ukrainian government has abruptly canceled its planned cryptocurrency airdrop and revealed it is instead going to be selling non-fungible tokens (NFTs) to raise funds The change was announced by Mykhailo Fedorov, Ukraine's minister for digital transformation.

In a tweet on his official Twitter account, Fedorov said that “after careful consideration” the Ukrainian government decided to cancel the airdrop and announced instead “ NFTs to support Ukrainian Armed Forces soon.” The minister added: “we DO NOT HAVE any plans to issue any fungible tokens.”

Ukraine’s airdrop announcement led to an influx of microdonations from users looking to take advantage of it, suggestions some were trying to game the airdrop via a Sybil attack on the country’s Ethereum wallet. Such an attack involves making small donations from multiple wallets in a bid to get a larger share of the airdrop.

|

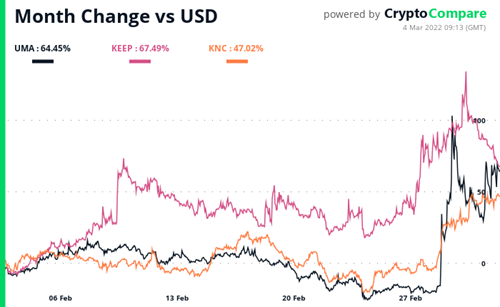

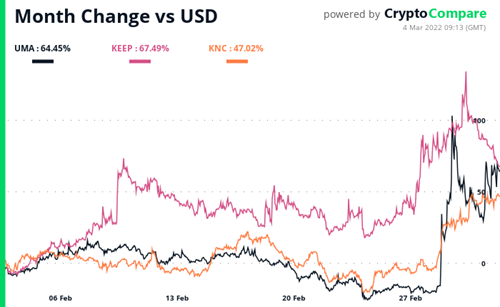

Crypto Market Movers – UMA, KEEP, KNC

|

Several tokens are leading the charge in the last 7-day period. Some of these are well-known cryptocurrencies with more liquid trading pairs, so we’ll be focusing on these over low-cap cryptos that may have higher percentage changes.

Uma (UMA) - UMA is designed to power the financial innovations made possible by permissionless, public blockchains, like Ethereum. Using concepts borrowed from fiat financial derivatives, UMA defines an open-source protocol that allows any two counterparties to design and create their own financial contracts. But unlike traditional derivatives, UMA contracts are secured with economic incentives alone, making them self-enforcing and universally accessible.

Keep Network (KEEP) - Keep is an incentivized network for storing and encrypting private data on the public blockchain. The network is made of off-chain containers for private data known as keeps, while the KEEP work token enables it to be completely permissionless. With Keep, developers can finally build fully decentralized apps. Visit Keep to learn more and stake, and tBTC to see its power in action.

Kyber Network (KNC) - KyberNetwork is an on-chain protocol which allows instant exchange and conversion of digital assets (e.g. crypto tokens) and cryptocurrencies (e.g. Ether, Bitcoin, ZCash) with high liquidity.

|

|

|

|

|

Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks. The simple average return across our suite of funds was 10.7% for the quarter, which is equivalent to an annualized return of 50%.

-

The Crypto10 Hedged (C10) fund offered the greatest returns over the quarter at 23.91%, far outstripping its benchmark of 1.66% and Bitcoin at 12.36%.

-

Crypto20, the flagship fund, had a stellar year registering a return of 334.98%, it significantly outperformed its Top 20 equally weighted benchmark, which rose 261.92%.

-

The Invictus Bitcoin Alpha (IBA) fund managed to outperform Bitcoin throughout the fourth quarter, marking a total return of 14.56%, accompanied by significantly less volatility.

-

The Hyperion venture capital fund continued on its impressive run, appreciating a further 5.05% off the back of a Quantfury dividend and Syntropy revaluation. The large dividend received by Quantfury will allow for a healthy level of buy-and-burn activity on the IHF token over the coming months.

-

Invictus Margin Lending (IML) Fund registered a 2.48% net return for the quarter against its 1.48% benchmark hurdle.

Invictus Capital is now on the cusp of a historic migration into a fully-regulated fund structure that will place us at the forefront of innovation within the asset management space. It should also bring our investors the peace of mind that comes with additional, 3rd-party oversight of our operations.

Disclaimer:

Cryptocurrency trading involves high risk, and is not suitable for all investors. Before deciding to trade cryptocurrencies, tokens or any other digital asset you should carefully consider your investment objectives, level of experience, and risk appetite.

Its content does not constitute financial advice. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice.

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CCDATA

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|