Goldman Sachs has started trading a type of derivative tied to ether (ETH). The asset, a non-deliverable forward, is meant to provide investors with indirect exposure to the second-largest cryptocurrency by market capitalization.

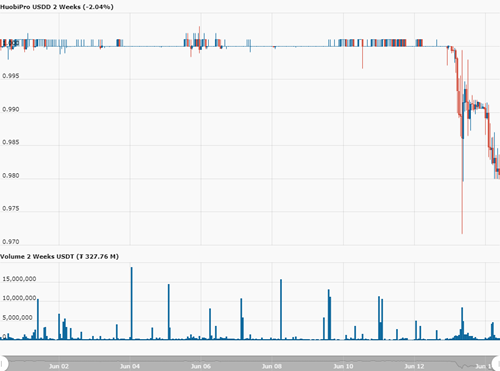

TRON’s algorithmic stablecoin USDD has lost its peg to the U.S. dollar, at one point dropping as low as $0.97 as short-sellers built up extreme positions against the cryptocurrency.

A survey conducted by Bank of America has found that of 1,000 existing and potential users of cryptocurrency and digital asset exchanges, 91% of respondents plan to buy crypto in the next six months.

Sponsored: Registrations are now open for Bybit World Series of Trading (WSOT) 2022. This year, the annual competition features an upsized prize pool worth up to a whopping $8 million, with attractive rewards, daily lotteries, NFTs, and much more.

Top stories in the Crypto Roundup today:

- Goldman Sachs Executes Its First Ether-Linked Derivative Trade

- TRON’s Stablecoin USDD Loses Dollar Peg

- Bank of America Survey Shows Consumers Plan on Buying More Crypto

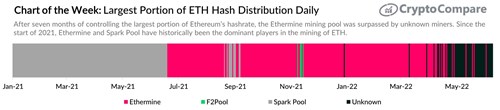

- Chart of the Week: Largest Portion of ETH Hash Distribution Daily

- Sponsored: Bybit WSOT 2022 — Solo or Squad?