|

|

The largest bank in the U.S., JPMorgan, has become the first to arrive in the metaverse, having opened a lounge in Decentraland, a virtual world based on blockchain technology. The bank has also released a paper on how businesses can find opportunities in the metaverse.

The Bank of Russia has started trialling its own central bank digital currency (CBDC), the digital ruble, in line with plans it made last year. Three banks out of 12 financial institutions in the digital ruble pilot have already integrated the CBDC platform.

The New York Stock Exchange (NYSE) has filed an application with the U.S. Patent and Trademark Office (USPTO) for an online marketplace selling various digital goods including non-fungible tokens, cryptocurrencies, digital media, and artwork.

This week we’re going to take a look at CryptoPunks in partnership with NFT data and discovery platform Masterpiece. CryptoPunks were released in June 2017 and are widely considered to be one of the first non-fungible tokens on the Ethereum blockchain, as such, they have become a widely sought after asset.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- JPMorgan Becomes First Bank to Enter the Metaverse

- Bank of Russia starts Trailing Digital Ruble CBDC

- NYSE Files Trademark Application for NFT Marketplace

- NFT Spotlight: CryptoPunk Sells For Record $23.4m

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

|

JPMorgan Becomes First Bank to Enter the Metaverse

|

The largest bank in the U.S., JPMorgan, has become the first to arrive in the metaverse, having opened a lounge in Decentraland, a virtual world based on blockchain technology. The bank has also released a paper on how businesses can find opportunities in the metaverse.

As non-fungible tokens (NFTs) started becoming mainstream last year, advances in the metaverse have been notorious over the last few months. The metaverse refers to a virtual reality world where users can interact, game, and experience things through technology.

Earlier this year Samsung opened a version of its New York store in Decentraland, while in November 2021 Barbados established a metaverse embassy, also in Decentraland. JPMorgan’s analysis pointed out that the average price of a parcel of virtual land doubled in the latter half of 2021 in all major Web 3 metaverse websites.

To the bank, the “virtual real estate market could start seeing services much like in the physical world, including credit, mortgages and rental agreements.” The firm also predicted in-game ad spending could reach $18.41 billion by 2027, and that working in the metaverse will be a reality.

|

Bank of Russia starts Trailing Digital Ruble CBDC

|

The Bank of Russia has started trialling its own central bank digital currency (CBDC), the digital ruble, in line with plans it made last year. Three banks out of 12 financial institutions in the digital ruble pilot have already integrated the CBDC platform.

Two of these banks have completed a “full cycle of digital ruble transfers between clients using mobile banking applications,” In an initial stage users open digital ruble wallets via a mobile application and convert fiat into the CBDC, so it can later be transacted.

At a second stage, the central bank is looking to test the digital ruble as a payment method for goods and services. In the future, the banks plan to introduce digital ruble payments while offline and make it available to transact for non-resident customers.

The Bank of Russia has said the CBDC is unique as it’s accessible via a “mobile application of any bank that serves the client.” Digital ruble transactions are set to be free and available in any region of the country.

|

NYSE Files Trademark Application for NFT Marketplace

|

The New York Stock Exchange (NYSE) has filed an application with the U.S. Patent and Trademark Office (USPTO) for an online marketplace selling various digital goods including non-fungible tokens, cryptocurrencies, digital media, and artwork.

If the NYSE follows up with these plans it would compete with popular NFT marketplaces like OpenSea and Rarible. The filing makes it clear the exchange may have ambitious plans for NFTs after it minted its first set in homages to six hot tech stocks that debuted on its platform.

These stocks included Spotify and Roblox. At the time, the NYSE clarified it wasn’t selling NFTs but only minting them.

|

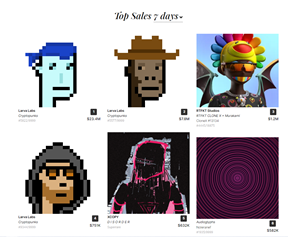

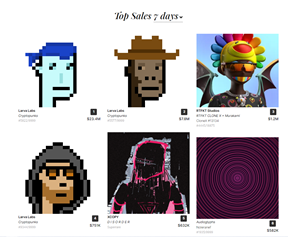

NFT Spotlight: CryptoPunk Sells For Record $23.4m

|

This week we’re going to take a look at CryptoPunks in partnership with NFT data and discovery platform Masterpiece. CryptoPunks were released in June 2017 and are widely considered to be one of the first non-fungible tokens on the Ethereum blockchain, as such, they have become a widely sought after asset.

Much like the wider NFT market, CryptoPunks saw their trading volumes boom in 2021, with high profile figures like JayZ, Snoop Dog, Serena Williams, Steve Aoki and Gary Vaynerchuck, all acquiring NFTs from the collection.

On the 1st of January 2021, 3 CryptoPunk’s were sold for $73,854. Just over a year later, CryptoPunk #5822, one of 9 “alien punks”, sold for 8000 ETH ($23,444,505). In the same week, Punk #5577 sold for $7.8m.

According to Larva Labs, the average sale price of a punk over the last year was 62.51 ETH ($194,738.74 USD) and the total value of punks sold over was 693,452.43 ETH ($2,160,291,567.14 USD).

|

|

|

|

|

Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks. The simple average return across our suite of funds was 10.7% for the quarter, which is equivalent to an annualized return of 50%.

-

The Crypto10 Hedged (C10) fund offered the greatest returns over the quarter at 23.91%, far outstripping its benchmark of 1.66% and Bitcoin at 12.36%.

-

Crypto20, the flagship fund, had a stellar year registering a return of 334.98%, it significantly outperformed its Top 20 equally weighted benchmark, which rose 261.92%.

-

The Invictus Bitcoin Alpha (IBA) fund managed to outperform Bitcoin throughout the fourth quarter, marking a total return of 14.56%, accompanied by significantly less volatility.

-

The Hyperion venture capital fund continued on its impressive run, appreciating a further 5.05% off the back of a Quantfury dividend and Syntropy revaluation. The large dividend received by Quantfury will allow for a healthy level of buy-and-burn activity on the IHF token over the coming months.

-

Invictus Margin Lending (IML) Fund registered a 2.48% net return for the quarter against its 1.48% benchmark hurdle.

Invictus Capital is now on the cusp of a historic migration into a fully-regulated fund structure that will place us at the forefront of innovation within the asset management space. It should also bring our investors the peace of mind that comes with additional, 3rd-party oversight of our operations.

Disclaimer:

Cryptocurrency trading involves high risk, and is not suitable for all investors. Before deciding to trade cryptocurrencies, tokens or any other digital asset you should carefully consider your investment objectives, level of experience, and risk appetite.

Its content does not constitute financial advice. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice.

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CoinDesk Data

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|