|

|

Bitcoin infrastructure company Blockstream, Tesla, and Block (formerly Square) are teaming up to create a Bitcoin mining facility powered by solar panels and battery chargers, which will be supplied by the electric vehicle maker.

The Luna Foundation Guard (LFG), the treasury backing the TerraUSD algorithmic stablecoin, has added $173 million in Bitcoin to its wallet over the weekend through a series of purchases, to now hold 39,897.98 BTC.

Nasdaq-listed cryptocurrency exchange Coinbase has disabled its support for the Unified Payments Interface (UPI) in India over the weekend days after it entered the Indian market.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- Tesla, Block, and Blockstream Team up on Solar-Powered Bitcoin Mining Facility

- Luna Foundation’s Treasury Nears 40,000 BTC

- Coinbase Disables UPI Payments Shortly After Launching in India

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

|

Tesla, Block, and Blockstream Team up on Solar-Powered Bitcoin Mining Facility

|

Bitcoin infrastructure company Blockstream, Tesla, and Block (formerly Square) are teaming up to create a Bitcoin mining facility powered by solar panels and battery chargers, which will be supplied by the electric vehicle maker.

The $12 million project is set to create 3.8 megawatts of renewable power and feature a publicly available performance dashboard. During the Bitcoin 2022 conference, Blockstream’s Adam Back explained that when trying to achieve financing for a renewable energy project “you need to demonstrate to financiers that you have a buyer for the power.” Adam Back added:

“Our initial theory, after talking with power producers, was that maybe Bitcoin mining could help grow zero-emission energy infrastructure.”

The project is being launched at a time in which Bitcoin’s energy use remains a widely debated topic, with ESG investors mostly staying on the sidelines because of the cryptocurrency’s energy consumption.

The Cambridge Bitcoin Electricity Consumption Index has noted Bitcoin’s total energy consumption, of 143 TWh/year, demands more than some countries. A report from Ark Invest, however, found the mining industry draws 76% of its power from renewable sources.

|

Luna Foundation’s Treasury Nears 40,000 BTC

|

The Luna Foundation Guard (LFG), the treasury backing the TerraUSD algorithmic stablecoin, has added $173 million in Bitcoin to its wallet over the weekend through a series of purchases, to now hold 39,897.98 BTC.

The LFG has been making several digital asset buys over the last few days to build up a reserve for USD. These include $230 million in Bitcoin and $200 million in Avalanche (AVAX). Terra’s founder, Do Kwon, has suggested the foundation will build a $10 billion reserve.

The AVAX reserve is set to be kept on the Avalanche blockchain, and the Terra network’s applications are also going to be launched on Avalanche as part of the deal. Terra’s BTC reserves, it’s worth noting, are in tokenized BTC on the Terra blockchain.

|

Coinbase Disables UPI Payments Shortly After Launching in India

|

Nasdaq-listed cryptocurrency exchange Coinbase has disabled its support for the Unified Payments Interface (UPI) in India over the weekend days after it entered the Indian market.

A note on Coinbase’s mobile application reads that “purchases using this payment method are temporarily unavailable.” Coinbase is the largest cryptocurrency exchange in the U.S. by trading volume and has seemingly caught the attention of the National Payments Corporation of India (NPCI).

After saying it would allow users to make crypto purchases using UPI, NPCI said in a statement that is it “not aware of any crypto exchange using UPI.” The payments system was developed by NCPI to facilitate inter-bank transactions using mobile devices.

The NPCI is part of an initiative from the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) to create a robust payment and settlement infrastructure in the country.

Regulatory uncertainty has also seen MobiKwik, one of the most widely used e-wallets for crypto transactions in India, halt its service.

|

Coinbase, Gemini, Bitstamp, and Binance Achieve Top Stops in CryptoCompare’s Exchange Benchmark

|

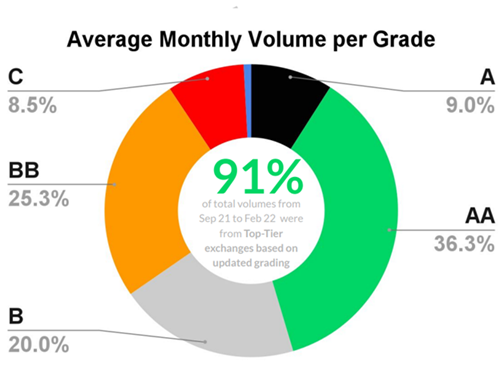

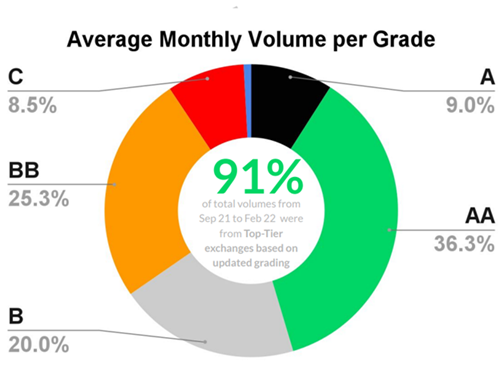

In CryptoCompare’s latest Exchange Benchmark, 79 cryptoasset exchanges met the threshold for Top-Tier status (ranking AA-B) compared to 87 in August 2021 due to stricter benchmark standards. Of these Coinbase, Gemini, Bitstamp, and Binance were awarded the highest grade, AA.

Out of the top 79 Top-Tier exchanges four received an AA rating while 11 received an A rating. 27 received a BB rating and 37 received a B rating. A total of 80 cryptoasset exchanges were ranked as Lower-Tier.

CryptoCompare created the Exchange Benchmark in 2019 to bring clarity to the digital asset exchange sector. As the risk assessment of exchanges continues to develop, it is important that the Exchange Benchmark reflects the increased scrutiny of financial regulators. In line with these changes, CryptoCompare has increased the stringency requirements for an exchange to be classified as Top-Tier.

A key finding in our most recent Exchange Benchmark was that know-your-customer (KYC) stringency still requires improvement on many exchanges, with 35% rated as having poor or inadequate KYC programs (vs 34% in Aug 2021). 27% of exchanges were also found to send funds to higher risk entities for more than 4% of transactions.

|

|

|

|

|

Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks. The simple average return across our suite of funds was 10.7% for the quarter, which is equivalent to an annualized return of 50%.

-

The Crypto10 Hedged (C10) fund offered the greatest returns over the quarter at 23.91%, far outstripping its benchmark of 1.66% and Bitcoin at 12.36%.

-

Crypto20, the flagship fund, had a stellar year registering a return of 334.98%, it significantly outperformed its Top 20 equally weighted benchmark, which rose 261.92%.

-

The Invictus Bitcoin Alpha (IBA) fund managed to outperform Bitcoin throughout the fourth quarter, marking a total return of 14.56%, accompanied by significantly less volatility.

-

The Hyperion venture capital fund continued on its impressive run, appreciating a further 5.05% off the back of a Quantfury dividend and Syntropy revaluation. The large dividend received by Quantfury will allow for a healthy level of buy-and-burn activity on the IHF token over the coming months.

-

Invictus Margin Lending (IML) Fund registered a 2.48% net return for the quarter against its 1.48% benchmark hurdle.

Invictus Capital is now on the cusp of a historic migration into a fully-regulated fund structure that will place us at the forefront of innovation within the asset management space. It should also bring our investors the peace of mind that comes with additional, 3rd-party oversight of our operations.

Disclaimer:

Cryptocurrency trading involves high risk, and is not suitable for all investors. Before deciding to trade cryptocurrencies, tokens or any other digital asset you should carefully consider your investment objectives, level of experience, and risk appetite.

Its content does not constitute financial advice. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice.

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CoinDesk Data

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|