|

|

A special economic zone on a tourist-centric island on Honduras’ coast has adopted Bitcoin and other cryptocurrencies as legal tender. The special zone, called Próspera, was established in 2020 to encourage investment and has administrative, fiscal, and budgetary autonomy.

Terraform Labs and the Luna Foundation Guard (LFG), the two main organizations behind the Terra blockchain, purchased a combined $200 million in AVAX to bolster UST’s reserves.

Cash App, the mobile payment service developed by Block (formerly known as Square), has announced that it’s rolling out three new Bitcoin-related services, including an option to automatically convert a percentage of a paycheck to BTC.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- Honduran Special Economic Zone Adopts Bitcoin as Legal Tender

- Terra Adds $200 Million in AVAX to Bolster UST’s Reserves

- Block’s Cash App Rolls Out Three Bitcoin-Related Services

- Crypto Market Movers – MINA, MPL, BAL

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

|

Honduran Special Economic Zone Adopts Bitcoin as Legal Tender

|

A special economic zone on a tourist-centric island on Honduras’ coast has adopted Bitcoin and other cryptocurrencies as legal tender. The special zone, called Próspera, was established in 2020 to encourage investment and has administrative, fiscal, and budgetary autonomy.

Honduras’ Próspera said in a statement that “Bitcoin and other cryptocurrencies effectively operate as legal tender within its jurisdiction” and added:

"Prospera's flexible regulatory framework enables crypto-innovation and the use of Bitcoin by residents, businesses, and governments."

The economic zone is also letting municipalities, local governments, and international firms issue Bitcoin bonds from its jurisdiction. Honduras’ neighboring country El Salvador adopted Bitcoin as legal tender in September 2021.

Following El Salvador, Mexican Senator Indira Kempis has vowed to focus on making Bitcoin legal tender in the country. Miguel Albuquerque, president of an autonomous region of Portugal called Madeira, also said that the region will focus on Bitcoin adoption.

|

Terra Adds $200 Million in AVAX to Bolster UST’s Reserves

|

Terraform Labs and the Luna Foundation Guard (LFG), the two main organizations behind the Terra blockchain, purchased a combined $200 million in AVAX to bolster UST’s reserves.

Terraform Labs, the company responsible for the development of Terra, swapped $100 million worth of its native token LUNA for AVAX to “strategically align ecosystem incentives,” according to an announcement.

The Luna Foundation Guard, a non-profit mandated to build reserves for Terra’s algorithmic stablecoin UST, used its own UST to buy an additional $100 million of AVAX from the Avalanche Foundation.

These purchases are set to reinforce UST’s stability. The LFG has over the last few weeks added over $1.6 billion of Bitcoin to its treasury reserves to back the stablecoin, with a goal of reaching $10 billion in BTC.

The Avalanche Foundation, after the two deals, holds $100 million worth of UST and $100 million worth of LUNA.

|

Block’s Cash App Rolls Out Three Bitcoin-Related Services

|

Cash App, the mobile payment service developed by Block (formerly known as Square), has announced that it’s rolling out three new Bitcoin-related services, including an option to automatically convert a percentage of a paycheck to BTC.

The feature would allow Cash App’s users to choose a specific percentage of their paycheck they would like to receive in BTC to automatically convert the funds once fiat currency came in through automated clearing house (ACH) rails.

Cash App’s other new Bitcoin services include Bitcoin Roundups, which lets users round up payments to the nearest dollar to buy BTC with the difference, and receiving Bitcoin through the Lightning Network.

Cash App integrated the Lightning Network in January, allowing consumers to easily use BTC at point-of-sale.

|

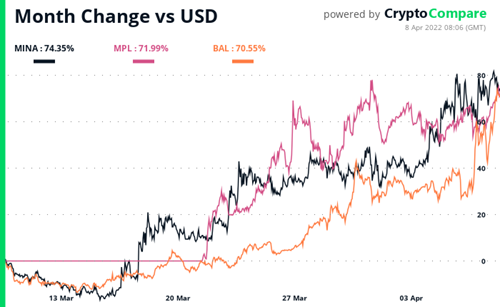

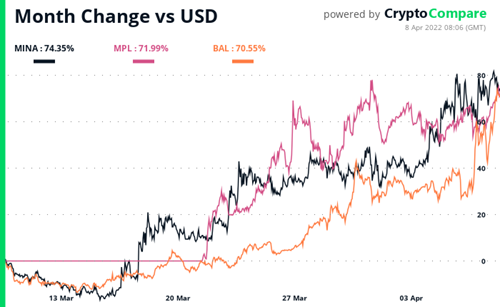

Crypto Market Movers – MINA, MPL, BAL

|

Several tokens are leading the charge in the last 7-day period. Some of these are well-known cryptocurrencies with more liquid trading pairs, so we’ll be focusing on these over low-cap cryptos that may have higher percentage changes.

Mina Protocol (MINA) - Mina is a light blockchain, powered by participants. It's building a privacy-preserving gateway between the real world and crypto — and the infrastructure for the secure, democratic future we all deserve.

Maple (MPL) - Maple Finance is an institutional capital marketplace powered by blockchain technology. On a mission to redefine capital markets through digital assets, Maple expands the digital economy by providing undercollateralized lending for institutional borrowers and fixed-income opportunities for lenders.

Balancer (BAL) – Balancer is an automated market maker that lets anyone add liquidity or create trading pools. Balancer’s pools can have up to eight tokens with different weights within the pool.

|

|

|

|

|

Invictus Capital continues to deliver an uninterrupted path of growth across all its funds

|

The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks. The simple average return across our suite of funds was 10.7% for the quarter, which is equivalent to an annualized return of 50%.

-

The Crypto10 Hedged (C10) fund offered the greatest returns over the quarter at 23.91%, far outstripping its benchmark of 1.66% and Bitcoin at 12.36%.

-

Crypto20, the flagship fund, had a stellar year registering a return of 334.98%, it significantly outperformed its Top 20 equally weighted benchmark, which rose 261.92%.

-

The Invictus Bitcoin Alpha (IBA) fund managed to outperform Bitcoin throughout the fourth quarter, marking a total return of 14.56%, accompanied by significantly less volatility.

-

The Hyperion venture capital fund continued on its impressive run, appreciating a further 5.05% off the back of a Quantfury dividend and Syntropy revaluation. The large dividend received by Quantfury will allow for a healthy level of buy-and-burn activity on the IHF token over the coming months.

-

Invictus Margin Lending (IML) Fund registered a 2.48% net return for the quarter against its 1.48% benchmark hurdle.

Invictus Capital is now on the cusp of a historic migration into a fully-regulated fund structure that will place us at the forefront of innovation within the asset management space. It should also bring our investors the peace of mind that comes with additional, 3rd-party oversight of our operations.

Disclaimer:

Cryptocurrency trading involves high risk, and is not suitable for all investors. Before deciding to trade cryptocurrencies, tokens or any other digital asset you should carefully consider your investment objectives, level of experience, and risk appetite.

Its content does not constitute financial advice. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice.

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CoinDesk Data

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|