|

|

Stone Ridge, a $10 billion asset manager, has announced that bitcoin is set to serve as its primary treasury reserve asset, and that it purchased over 10,000 BTC – worth over $100 million – as part of its “treasury research strategy.”

Fidelity Digital Assets has said bitcoin’s market cap has plenty of room to grow in a report on the flagship cryptocurrency’s uncorrelated nature with traditional assets.

JPMorgan analysts have said in a report that Square’s $50 million investment in bitcoin is a “strong vote of confidence for the future of bitcoin” a signal the company sees “a lot of potential” in BTC as an asset.

Sponsored: Covesting allows its users to browse through hundreds of strategies provided by other traders, and automatically copy their trading activity. With Covesting, you can achieve the same returns as the leading traders on the platform. Top traders earn up to +1700% per month!

Top stories in the Crypto Roundup today:

- Stone Ridge Reveals $113 Million Investment in Bitcoin

- Bitcoin’s Market Cap is ‘Drop in the Bucket’ of Potential, says Fidelity Report

- JPMorgan Says Square’s $50 Million Bitcoin Bet is ‘Strong Vote of Confidence’ for BTC

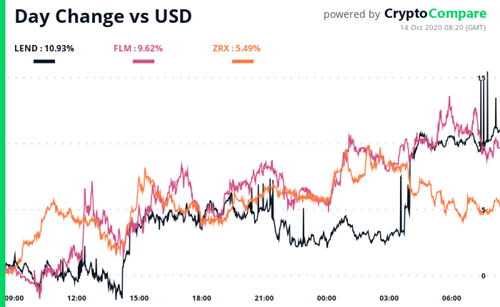

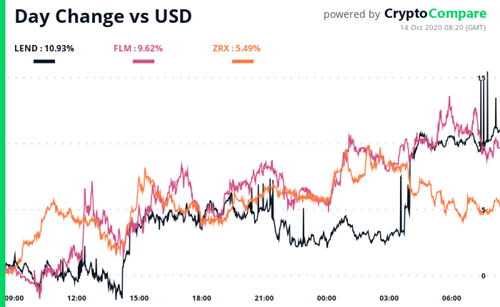

- LEND, FLM, ZRX Are Moving in the Crypto Market

- Sponsored: PrimeXBT - Discover Covesting and Trade like a Pro! Follow Leading Traders and Profit Together!

|

|

Stone Ridge Reveals $113 Million Investment in Bitcoin

|

Stone Ridge, a $10 billion asset manager, has announced that bitcoin is set to serve as its primary treasury reserve asset, and that it purchased over 10,000 BTC – worth over $100 million – as part of its “treasury research strategy.”

The cryptocurrency purchase was executed by and is custodied at its digital asset subsidiary New York Digital Investment Group LLC (NYDIG). NYDIG’s co-founder and CEO Robert Gutmann said:

“We are proud to have facilitated one of the largest commitments of treasury assets to Bitcoin announced to date, and see demand for our full suite of corporate treasury and investment solutions accelerating.”

The news follows similar investment announcements from Square's Jack Dorsey, which invested $50 million to “purchase approximately 4,709 bitcoins,” and from MicroStrategy, which “purchase 38,250 bitcoins at an aggregate purchase price of $425 million.”

|

Bitcoin’s Market Cap is ‘Drop in the Bucket’ of Potential, says Fidelity Report

|

Fidelity Digital Assets has said bitcoin’s market cap has plenty of room to grow in a report on the flagship cryptocurrency’s uncorrelated nature with traditional assets.

Ria Bhutoria, Director of Research at the firm, wrote the cryptocurrency’s current market capitalization is a “drop in the bucket” compared with markets BTC could disrupt. He argued that while institutional inflows may affect its uncorrelated performance, the cryptocurrency is “fundamentally less exposed” to the “economic headwinds” other assets face.

The report added that in a world where “where benchmark interest rates globally are near, at, or below zero, the opportunity cost of not allocating to bitcoin is higher.”

|

JPMorgan Says Square’s $50 Million Bitcoin Bet is ‘Strong Vote of Confidence’ for BTC

|

JPMorgan analysts have said in a report that Square’s $50 million investment in bitcoin is a “strong vote of confidence for the future of bitcoin” a signal the company sees “a lot of potential” in BTC as an asset.

Square’s $50 million bitcoin bet came after MicroStrategy bought $425 million worth of bitcoin. Per JPMorgan’s analysts, other payment companies are likely going to follow Square’s footsteps or risk getting shut out of a growing segment. Square itself, they wrote, is likely to make more purchases.

As Square’s users have been buying BTC through the Cash App, demand for BTC exceeded supply at a greater level than Q2’s in Q3, partly thanks to MicroStrategy’s purchases as well. Despite the rising demand, JPMorgan’s team noted that the bitcoin sell-off in September only partly alleviated what it described as overbought conditions.

|

LEND, FLM, ZRX Are Moving in the Crypto Market

|

There are several tokens leading the charge in the last 24-hour period. Some of these are well-known cryptocurrencies with rather liquid trading pairs, so we’ll be focusing on these over low-cap cryptos who may have higher percentage changes.

Aave (LEND) – The governance token of the decentralized finance lending protocol Aave, LEND, had seen its price surge amid its migration to its new ticker symbol AAVE. The migration is made at a rate of 100 LEND per 1 AAVE. The token is up over 10.9% in the last 24 hours.

Flaming (FLM) – The price of Flamingo’s FLM token is up 9.6% in the last 24 hours. Flaming is an interoperable, full-stack decentralized finance protocol built on the Neo blockchain.

0x (ZRX) – 0x is an open protocol that facilitates the decentralized exchange of Ethereum-based tokens and assets. Developers can use 0x to build their own custom exchange apps with a wide variety of user-facing applications. ZRX is up nearly 5.5% in the last 24 hours.

|

|

|

|

|

PrimeXBT - Discover Covesting and Trade like a Pro! Follow Leading Traders and Profit Together!

|

Covesting allows its users to browse through hundreds of strategies provided by other traders, and automatically copy their trading activity. With Covesting, you can achieve the same returns as the leading traders on the platform. Top traders earn up to +1700% per month!

Every trader can monetize their skills and earn second income by receiving success fees from their followers. The more followers they will acquire - the more money they’ll make from profitable trading. It's a unique win-win solution for all!

Get your free account today, and enjoy Bitcoin-based margin trading platform which offers access to over 50+ assets including Crypto (Bitcoin, Ethereum, Litecoin, Ripple, EOS), Forex, Commodities (Metals, Oil, Gas), and Indices from a single account. Benefit from privacy, security, liquidity, and 24/7 support!

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CoinDesk Data

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|