|

|

On-chain analysis conducted by Whale Alert found that Bitcoin’s creator Satoshi Nakamoto mined an estimated 1,125,150 BTC, worth around $10.9 billion.

San Francisco-based cryptocurrency exchange Coinbase has revealed it prevented 1,100 users from sending over $280,000 worth of bitcoin to the hackers who hijacked dozens of high-profile Twitter accounts.

The Ontario Securities Commission has accused crypto exchange Coinsquare of market manipulation. The regulator accuses the exchange of implementing an algorithm to inflate trading volumes.

Sponsored: Crypto.com Exchange is listing Kyber Network (KNC) on The Syndicate, where all Crypto.com Coin (CRO) stakers will be able to participate in a discounted sale event for 500,000 USD worth of KNC at 50% off.

Top stories in the Crypto Roundup today:

- Whale Alert Estimates Satoshi Nakamoto mined 1.12 million BTC

- Coinbase Says It Prevented 1,100 Users From Sending BTC to the Twitter Hackers

- Coinsquare Accused of Market Manipulation by Canadian Regulator

- Sponsored: Crypto.com Exchange is listing KNC at 50% OFF

At the time of writing, bitcoin (BTC) is trading at $9,184.05 (0.25%) with a daily Top Tier volume of $1.20 bn. As for ether (ETH), it is trading at $238.66 (1.60%) with a daily Top Tier volume of $465.43 million. The MVIS CryptoCompare Digital Assets 10 Index is currently tracking at 3,190.00 (-0.30%).

|

|

Whale Alert Estimates Satoshi Nakamoto mined 1.12 million BTC

|

On-chain analysis conducted by Whale Alert found that Bitcoin’s creator Satoshi Nakamoto mined an estimated 1,125,150 BTC, worth around $10.9 billion.

In a Medium post, the researchers revealed they believe Satoshi Nakamoto kept on mining BTC with the same equipment until at least May 2010. Their findings were based on Sergio Demian Lerner’s 2013 “extra nonce” technique, which claimed Satoshi had a stash of at least 1 million BTC. Satoshi’s mining pattern was referred to as the “Patoshi” pattern.

Whale Alert identified a set of nonce patterns more specific to the Patoshi pattern, which helped them identify possible blocks mined to Satoshi. Per Whale Alert, Satoshi mined 22,503 of the first 54,316 blocks on the Bitcoin blockchain.

While the network was growing, Satoshi maintained a constant mining scheme to protect it against possible 51% attacks, Whale Alert’s researchers suggest. The reliability of these patterns, it’s worth noting, has been called into scrutiny by BitMEX Research two years ago, after they estimated Satoshi mined around 700,000 BTC.

|

Coinbase Says It Prevented 1,100 Users From Sending BTC to the Twitter Hackers

|

San Francisco-based cryptocurrency exchange Coinbase has revealed it prevented over 1,100 of its users from sending bitcoin to the Twitter hackers who hijacked dozens of high-profile accounts to promote a fake bitcoin giveaway.

According to Philip Martin, the exchange’s chief information security officer, if Coinbase didn’t stop its users from sending over the funds, they would have collectively lost 30.4 BTC, currently worth about $280,000. The hackers, in total, netted around $120,000.

Despite the exchange’s move to backlist the addresses associated with the hack, 14 of its customers still managed to send around $3,000 worth of BTC to the hackers before Coinbase managed to act. Forbes reports that users from Binance, Kraken, and Gemini also tried sending bitcoin to the addresses.

The Twitter hack, it’s worth noting, saw hackers hijacked the accounts of high-profile figures like Elon Musk, Barack Obama, Joe Biden, Bill Gates, as well s the accounts of crypto exchanges Coinbase, Binance, and Gemini. They used their access to promote a fake bitcoin giveaway.

|

Coinsquare Accused of Market Manipulation by Canadian Regulator

|

The Ontario Securities Commission (OSC) has accused cryptocurrency exchange Coinsquare of market manipulation representing roughly 90% of the platform’s total trading volume.

According to a statement issued by the OSC, the regulator accused the crypto trading platform of engaging in “market manipulation through the reporting of inflated trading volumes.” The statement claims Coinsquare misled clients on its trading volume and took “reprisal against an internal whistleblower.”

Its President and Founder Virgile Rostand allegedly created an algorithm in July 2018, at the direction of CEO Cole Diamond, to “inflate the trading volumes reported on the Coinsquare Platform.” The report detailed:

“Between July 17, 2018, and December 4, 2019, the Market Volume Function resulted in approximately 840,000 wash trades on the Coinsquare platform, with an aggregate value of approximately 590,000 bitcoins.”

Per the OSC, Coinsquare’s activities were “contrary to the public interest.”

|

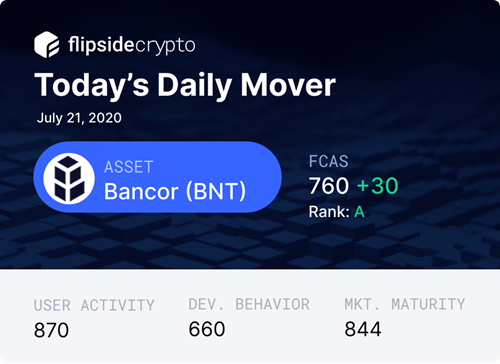

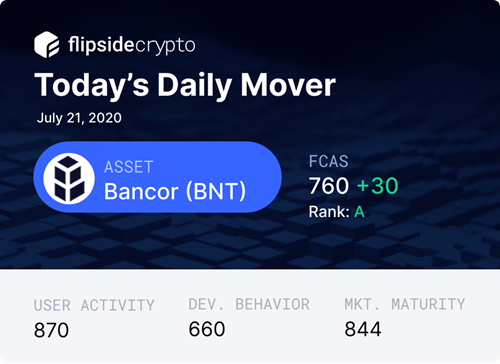

Bancor (BNT) is the Daily Mover

|

This week’s Daily Mover featured asset is Bancor (BNT, an on-chain liquidity protocol that enables the exchanges of various tokens on the Ethereum and EOS blockchains via the use of smart contracts that manage liquidity pools. These pools are used to make an exchange and are created by everyday users participating as market maters who earn fees for providing liquidity to the pools.

The BNT token facilitates trades on Bancor, and its FCAS score has climbed 4.11% in the past month, thanks to a 4.32% rise in User Activity, and a 4.1% increase in Developer Behavior. Market Maturity went up 3.81% over the same period. BNT’s price went up 122% while its FCAS climbed.

BNT’s FCAS went up thanks to the announcement of a new version of Bancor’s on-chain liquidity protocol, which will mitigate the risks that liquidity providers face for participating in the network. The upgrade, Bancor V2, introduced an automated market maker liquidity pools that hold the relative value of reserves constant, using Chainlink oracles.

This offers a solution to liquidity providers who suffer from “impermanent loss” and “multi-token exposure.” The announcement helped Bancor’s BNT earn the first place among the best performing decentralized finance tokens in the second quarter of this year.

|

|

|

|

|

Crypto.com Exchange is listing KNC at 50% OFF

|

Crypto.com Exchange is listing Kyber Network (KNC) on The Syndicate, where all Crypto.com Coin (CRO) stakers will be able to participate in a discounted sale event for 500,000 USD worth of KNC at 50% off. The event commenced on Tuesday, 21 July 6:00am UTC on the Crypto.com Exchange.

Allocation:

Each participant’s maximum amount of CRO that can be applied towards the listing event will depend on the amount of CRO Staked on the Crypto.com Exchange.

Subscription:

- Participants will be able to subscribe for KNC by contributing an amount of CRO tokens not exceeding their respective maximum allocation

- Staked CRO tokens may not be used to subscribe for KNC in the listing event

Event Timeline:

- 21 July 6:00am UTC: Sales Begins (KNC/CRO subscription price fixed)

- 22 July 6:00am UTC: Sales Ends

- 23 July 6:00am UTC: Acceptance Period Begins (unused CRO will be refunded immediately if you reject the allocation)

- 24 July 6:00am UTC: Acceptance Period Ends (CRO refunds will be distributed for forfeited participants)

Sign up for the Crypto.com Exchange, stake CRO and participate in the KNC sale now!

|

|

|

|

|

State of the Crypto by Top Tier Exchange Volume

|

Build your project with CoinDesk Data

|

|

|

|

Terms

| Privacy

13 Charles II St, SW1Y 4QU

London, UK

This email may include advertisements by third parties. None of the advertised or promoted products and services have been verified or approved by us and this email is not any endorsement by us of the third party or of their products or services.

|

|

|

|

|